unfiled tax returns and stimulus check

Filing six years 2014 to 2019 to get into full compliance or four years 2016 to 2019 to just focus on available refunds. If you only see the option to amend 2018 or earlier its because you cant amend an unfiled 2019 return.

Irs News Announcements Taxgirl

There is generally a 10-year time limit on collecting taxes penalties and interest for each year you did not file.

. If you havent filed you should file a return immediately at least for 2018. The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further enforce the law. You would have had to file the amended return by Oct.

This includes any extension of time to file the IRS grants you. For example if you owed 1000 in taxes but had a refundable tax credit of 1200 youd get a 200 tax refund check from Uncle Sam. Click the link and then provide basic information including Social Security number name address and dependents.

The rest of the 3600 and 3000 amounts should have been claimed when parents filed. There isnt a minimum earned income threshold to qualify for a payment. July 10 2020.

If your return wasnt filed by the due date including extensions of time to file. The registration process was intended as a way for those who arent required to file taxes to submit important address and other information to the IRS. 15 2025 to obtain a fund.

However you can earn too much income phaseouts will result in reduced payment for higher adjusted gross incomes. You can still get a stimulus check even with unfiled tax returns. Visit IRSgov and look for Non-Filers.

If youre concerned about your refund being held because of unfiled returns you. Tax not paid in full by the original due date of the return regardless of extensions of time to file may also result in the failure-to-pay. To initiate a refund claim you have to file an amended tax return.

However in some cases the IRS may keep your refund if you have not filed a prior-year return and it appears that youll owe money when you do. State tax agencies have their own rule and many have more time to collect. Instead just select Pick up where you left off make your changes and disregard the rest of these instructions.

Because youre getting what amounts to a refundable tax credit now in the form of a third stimulus payment rather than waiting to get the money from the credit in 2022 when you actually file your 2021 tax return youre in effect. The three-year period begins on filing deadline in the year immediately following the close of the relevant tax year. Those without 2018 tax filings on record could potentially affect mailings of stimulus checks the site says.

However if you do not file taxes the period of limitations on collections does not begin to run until the IRS makes a deficiency assessment. IRS increasing focus on taxpayers who have not filed tax return. If you do not file taxes or receive Social Security benefits you qualify for a Stimulus Check.

While most Americans will receive a coronavirus stimulus check based on their tax returns the IRS is urging certain groups that do not typically file taxes to do so as soon as they can. The IRS hopes most non-filers will go online and use the Enter Your Payment Info Here tool but it also announced alternative procedures for filing simplified tax returns. You may also have been exempt from filing unfiled tax returns in the past because your income did not qualify to file for tax returns you are eligible to receive payment.

Your 2016 tax refund is actually available UNTIL July 15 2020. Unfiled Taxes Could Affect Your Coronavirus Stimulus Check. Scroll down to Your tax return documents you may need to select Show select 2019 and then Amend change return.

This spring millions of taxpayers registered to get a stimulus payment through the IRS non-filer tool or by filing a 1 stimulus return through a tax prep service. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure to file timely. Unemployment and a stimulus check.

May cause you to have your. 9 Million Unclaimed Stimulus Checks The IRS says that roughly 9 million Americans who typically do not file a federal income tax return are still entitled to an Economic Impact Payment the. The IRS doesnt automatically keep tax refunds simply because you didnt file a tax return in a previous year.

Most people are eligible to get a stimulus if they meet the required threshold. As we have previously recommended if you havent filed taxes in a long time you should consider two paths. For most of us filing our 2018 and 2019 returns is a good idea to see if we are eligible for a stimulus check.

To get the 1200 Stimulus Check single 2400 married couple and. There is an Abundance of IRS Non Filers Unfiled Tax Returns Non Filers or Unfiled Tax Returns In the eyes of the IRS non-filers of taxes is a serious offense. Single filers with income over 75000 will have their stimulus check reduced by 5 for every 100 over 75000.

Millions Are IRS Non Filers Failing To File A Tax Return. The simple steps for those who dont normally file a tax return are. In the coming week or so the IRS will first look at your 2019 return and if the 2019 is not filed then the IRS will look at your 2018 return.

The IRS will use the information submitted in the online form to confirm eligibility. Enter Payment Info Here. March 27 2020 Back Tax Relief Stimulus Check Unfiled Returns.

1 day agoInitially families received the child tax credit monthly payments of 300 or 250 from July to December 2021. The 2020 Stimulus Check and Unfiled Tax Returns. In addition the IRS is increasing the use of data analytics research and new compliance strategies including.

However you may need to jump through a few hoops first.

Have Unfiled Tax Returns As A Us Expat Here S What To Do About It

Everyday Income Tax Services Home Facebook

Still Didn T Get Your Stimulus Checks File A 2020 Tax Return For A Rebate Credit Even If You Don T Owe Taxes

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

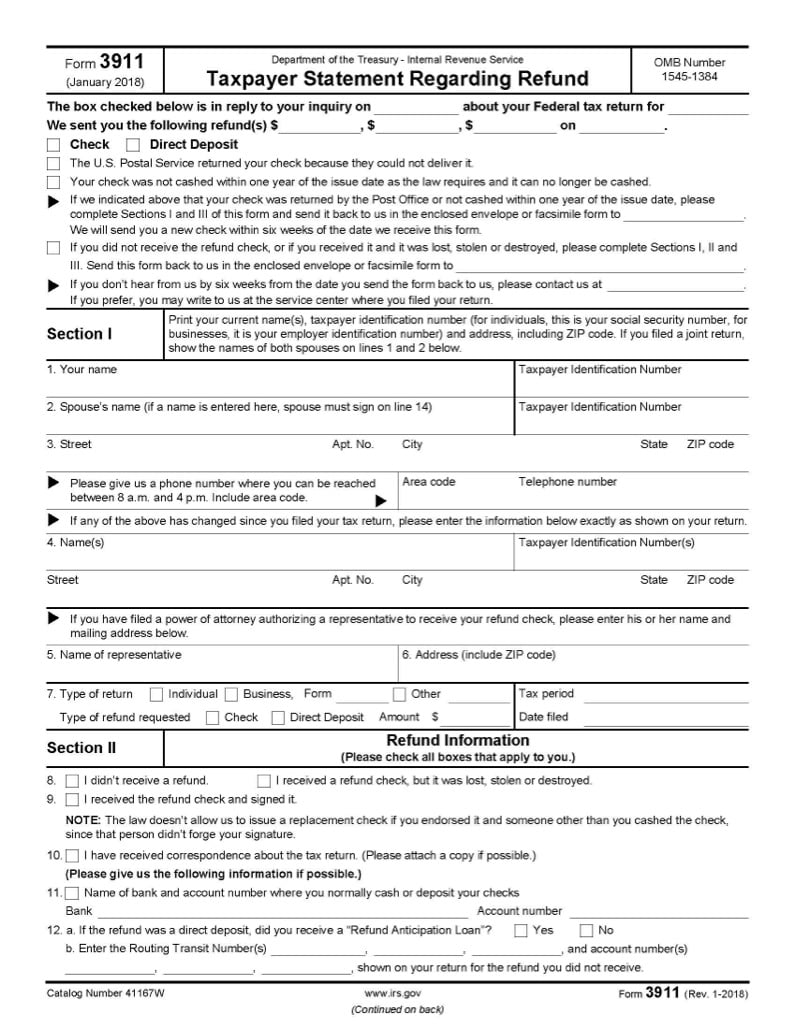

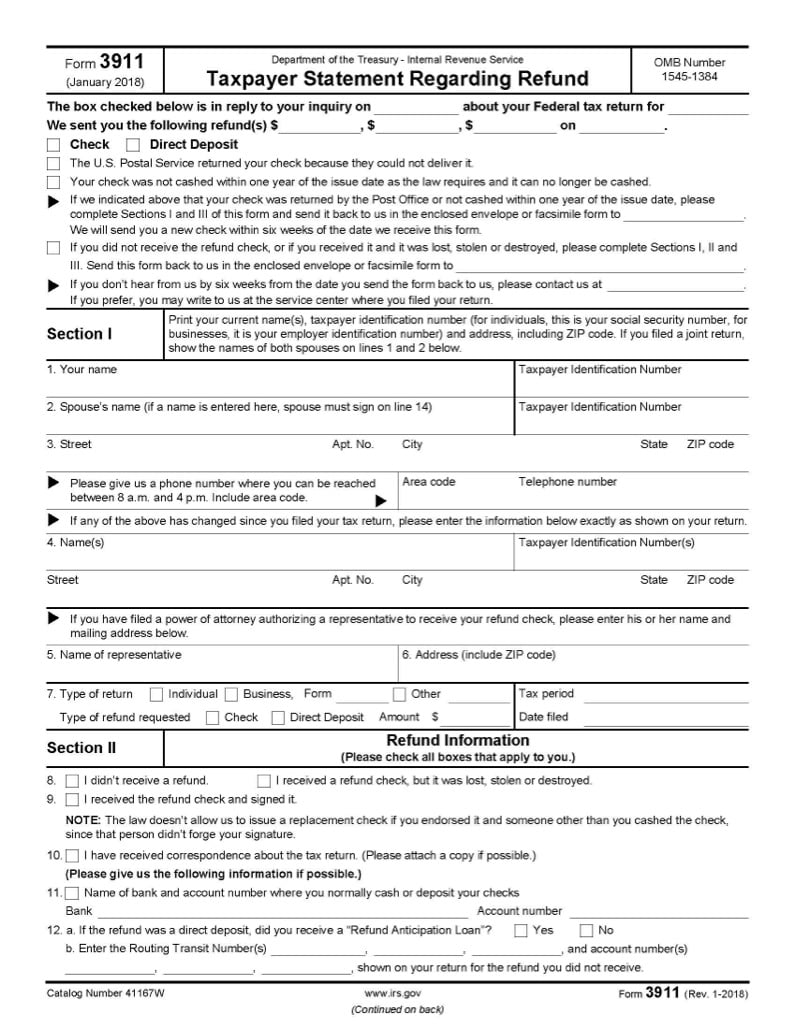

Form 3911 Never Received Tax Refund Or Economic Impact Payment

8 Tips To Filing Us Expat Taxes La Vie Locale

Irs Stops Scary Tax Notices But You Still Need To Pay Up

Form 3911 Never Received Tax Refund Or Economic Impact Payment

1 5 Billion In Refunds Attached To Unfiled 2018 Tax Returns Available Until April 18 Gobankingrates

2022 Tax Season 7 Signs The Irs Is A Mess This Year Money

Unfiled Tax Returns Back Taxes Jacksonville Tax Attorney

Irs The Notices Will Stop But You Still Need To Pay Fingerlakes1 Com

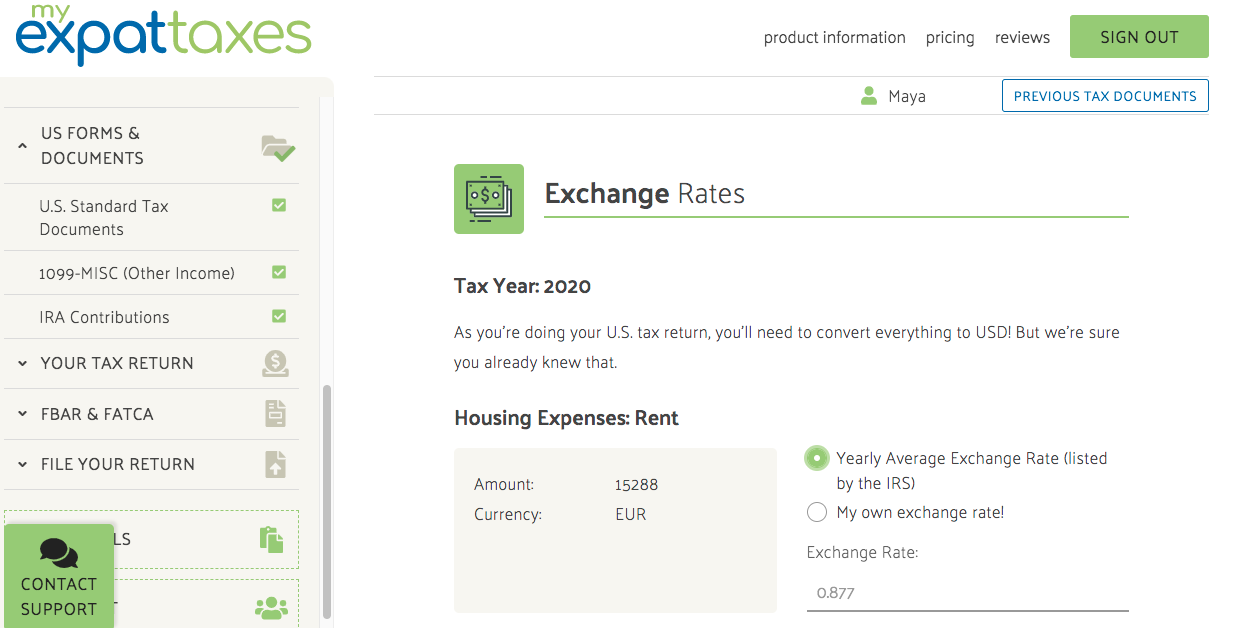

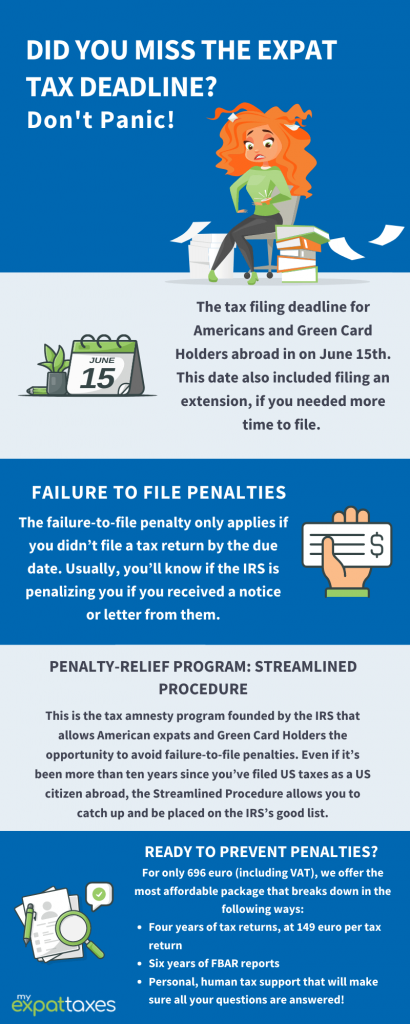

Missed The Expat Tax Deadline In 2022 Myexpattaxes

You Can Now Get A Stimulus Check Even If You Haven T Filed Taxes Dansdeals Com

Irs Mind Staff Author At Irs Mind

Have Unfiled Tax Returns As A Us Expat Here S What To Do About It

8 Tips To Filing Us Expat Taxes La Vie Locale

What Happens If You Don T File Taxes As An Expat Myexpattaxes